Our Services

What We Do

Upgrade My Credit has been helping people clear up their credit reports, resulting in significantly increased FICO scores for almost 5 years. With higher scores many of our clients have been able to qualify for home and auto loans, save on insurance rates, get better jobs, and even get security monitoring after being turned down.

We are a firm helping hardworking men and women repair their credit reports while building new, positive credit profiles and higher scores. We help by getting inaccurate, misleading, or unverifiable items removed — from bankruptcies to charge-offs, late payments to judgments, medical bills to tax liens. We have legally, morally and ethically challenged and successfully deleted such items through our vast knowledge and mastery of the more than 240 laws related to credit reporting, debt collection and billing, such as The Fair Credit Reporting Act, Fair Debt Collection Practices Act, Consumer Credit Act, and the Data Protection Act. Such laws were put in place to curb the abused of the credit reporting industry and govern the sharing of information. The laws are for you, and it is your right.

What can Upgrade My Credit deal with on my credit reports?

|

|

|

We get erroneous, unverifiable, and outdated items deleted off reports from all three major bureaus! |

|

|

An Overview of How It Works

Step 1: Detailed Analysis of Your Credit Report

- Once we’ve received your credit reports, we will analyze your credit history to identify items that are responsible for bringing your credit score down – including not having enough current positive credit. From this analysis we will put together what we call a P2OA (Personalized Plan of Action) from which we draw to begin step 2.

Step 2: Initiate an Investigation

- Then we will draft customized letters to dispute the negative items on your behalf. This is a very important step since according to federal law, the credit bureaus can ignore your disputes under a variety of conditions. In our experience, a large number of dispute letters drafted and sent by consumers are rejected for one reason or another. Upgrade My Credit’s letters are expertly designed such that credit bureaus will accept the dispute and conduct an investigation.

Note: A disputed credit listing must be verified as accurate for it to remain on the credit report. If the credit listings contain an error, the credit bureau may simply correct the item, but, very often, disputed credit items cannot be verified because either the creditor either no longer possesses necessary information or does not to go to the effort of verifying it, resulting in deletion. Furthermore, the investigation must be completed within 30 days or the listing must be removed. For these reasons, properly disputed credit listings are removed from your credit report with remarkable frequency.

Step 3: Receive and evaluate results of the investigation:

- At the conclusion of the credit bureau’s investigation, a new copy of the credit report is sent to you along with any deletions or improvements. You then provide us with a copy of the new credit report and result letters.

Step 4: Continue your Personalized Plan of Action

- The cycle repeats itself at strategic intervals according to your personalized plan of action. Each time an investigation is initiated, the odds of receiving a particular deletion increases. We do not stop until all realistic and legal options are explored and implemented.

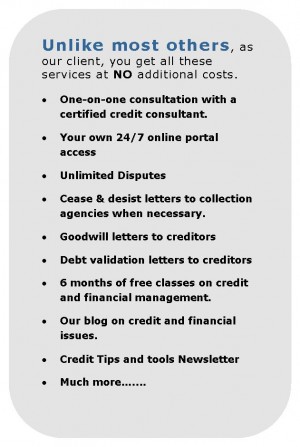

This is the basic process and only the tip of the iceberg of our professional services (see the sidebar on the right to see some of reasons we are set apart from other credit services companies). For more details please talk to a representative for a personalized analysis of your specific situation by calling 888-612-0223, or sending an email to info@upgrademycredit.com, or take advantage of our FREE credit consultation >>.

![]()