How Are FICO Scores Determined?

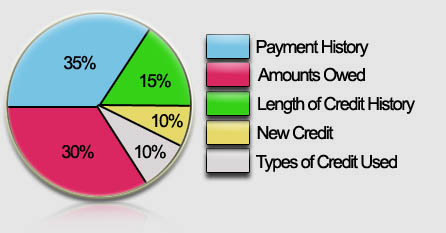

March 28, 2012 | Posted by Blair Warner | 2 CommentsThere are five factors that contribute to determining your credit score:

-

Payment History

Amount Owed (ratio)

Length of Credit History

Taking on More Debt (Inquiries)

Types of Credit in Use

1. How you pay your bills – Your credit history (35 percent of the score)

This is the most important factor; how you’ve paid your bills in the past, with the strongest emphasis on recent activity (2 years or less.) Paying all your bills on time is good. Paying them late is not, and particularly on a consistent basis. Few things hurt your score as heavily as past due payments. Having accounts that were sent to collections is even worse. Declaring bankruptcy is the worst. Think long and hard before filing for bankruptcy. It most cases, it simply isn’t worth it.

2. Your debt to your available credit ratio (30 percent)

The second most important area is your outstanding debt — how much money you owe on unsecured and secured loans, with emphasis on revolving credit. Revolving credit is credit cards, and lines of credit. Installment loans include car loans, personal loans, mortgages, etc.). The ratio of available credit to debt (account balance) is an important ratio. Try to keep the ratio of available credit to credit used, also called utilization ratio, below 30%.

Some underwriters place importance on the total amount of credit you have available. If you have 10 credit cards that each have $5,000 credit limits, that’s $50,000 of available credit. Statistically, people who have a lot of credit available tend to use it, which makes them a less attractive credit risk. However, please note, this is less important to FICO’s credit score algorithm.

3. Length of credit history (15 percent)

The third consideration is the length of your credit history. The longer you’ve had credit — particularly if it’s with the same credit issuers — the more points you’ll get.

4. Types/Mix of credit (10 percent)

The best scores will have a mix of both revolving credit, such as credit cards, and installment credit, such as mortgages and car loans. “Statistically, consumers with a richer variety of experiences are better credit risks,” Watts says. “They know how to handle money.”

5. New credit applications – Also called inquiries (10 percent)

The final category is how many credit applications you’re filling out, called intquiries. The scoring model compensates for people who are rate shopping for the best mortgage or car loan rates, but not for revolving type loans, payday loans, etc. The only time shopping really hurts your score is when you have previous recent credit stumbles, such as late payments or bills sent to collections.

It is our greatest desire that our blog posts are helpful to you. Your comments and thoughts are welcome.

By Blair Warner

Google Plus Profile

Upgrade My Credit Home Page