Frequently Asked Questions

Here are some of our most frequently asked questions.

Click on the question to scroll down to the answer!

- How does your program work?

- What are the advantages of using Upgrade My Credit?

- Can you guarantee results?

- Are you members of a trade association?

- Should I sign up my spouse at the same time?

- How can we build new credit?

- Do you share our personal information with anyone?

- How do I send you my credit reports?

- When I request my report, does it hurt my credit scores?

- Can you order our credit reports for us directly?

- How much does bad credit cost me?

- How long have you been doing credit repair?

- How does the process work?

- How long does it take?

- What if removed items reappear?

- Is credit repair legal?

- Is it legal for Upgrade My Credit to help me?

- How much does your service costs?

- What is a credit score?

- What is my credit score based on?

- How can bad credit be deleted?

- Do I need to pay my bills?

- What do I need to do to get started?

- More Questions? Click our ASK US button on the left and ask away!

How does your program work?

See the question “How does the process work?” Back to Questions

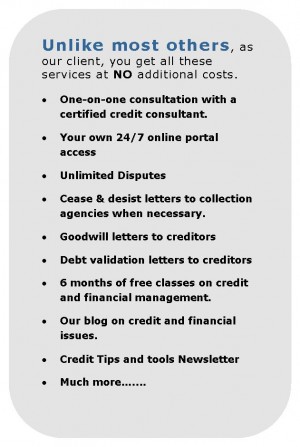

What are the advantages of using Upgrade My Credit?

While there are many companies who brand themselves as credit repair organizations, most of them lack the breadth of experience and expertise necessary to adequately represent your credit restoration efforts. Some of the specific advantages of using Upgrade My Credit are:

We can dispute claims directly with creditors.

We enforce your rights under the various federal and state credit laws.

On your behalf we can demand a creditor address and settle debts.

We research and keep current our knowledge of consumer laws and their changes, interpretations, and applicability of those laws.

We govern ourselves according to the rules and principles of professional conduct.

And many more…. ( See What Makes Us Different ) Back to Questions

Can you guarantee results?

By law, no company can guarantee that they can have items removed from your credit reports, but we stand behind our services and, if you feel you do not see results, we will evaluate your account and you will receive a portion of your money back if appropriate progress with your case has not been made. Please refer to our Terms of Use and Guarantee for more details. Back to Questions

Are you members of a trade association?

Yes, we are proud members of the National Association of Credit Services Association, as well as licensed and bonded in the state of Texas. Don’t do business with someone who is not. Back to Questions

Should I sign up my spouse at the same time?

We are happy to offer a 40% discount for couples to encourage you to sign up at the same time, and you don’t have to be married to be considered a couple for the discount. It is important for both of you to have good credit in order to reach your credit goals. When you sign up, we will set up separate files and you will each get the benefit of individualized attention.

Back to Questions

How can we build new credit?

Part of our job is to guide you through the process of making sure you have enough good, current credit since FICO scoring weighs heavily on the last 24 months credit history. Often we accomplish this by helping you open secured credit cards and lines of credit, but without getting in further debt. These are a couple of the best ways to rebuild credit and improve your credit scores. A secured credit card requires a small savings deposit which usually secures the entire credit line on a MasterCard or Visa. We will cover this more once you sign up. Back to Questions

Do you share my personal information with others?

We believe in privacy, and we do not share your information with anyone. You may see our Privacy Policy for additional details.

Back to Questions

How do I send you my credit reports?

You need all three bureau reports, or a tri-merged report, to get started. Do you already have your reports? You will get instructions for getting them to us either via FAX or email when you sign up. If you do not have your reports, we will provide a link to our favorite low-cost tri-merged report, which you can buy online in minutes for only a $1. Once you have your reports, contact us. Back to Questions

When I request my report, does it hurt my credit scores?

When you request your own report it has no impact on your credit scores. There are two types of inquiries, “hard” and “soft”. A hard inquiry will affect your score – and occurs when you apply for new credit. A soft inquiry will not affect your score – and occurs in three instances: 1) when you request your own credit report, 2) when potential lenders check your credit prior to offering you pre-approved credit, and 3) when a current lender conducts a periodic review of an existing account. Back to Questions

Can you order our credit reports for us directly?

No. The Fair Credit Reporting Act (Section 604) prohibits the credit bureaus from furnishing credit reports to third parties for any reasons outside of the FCRA definition of “permissible purposes” which include determination of credit worthiness, underwriting of insurance, and employment screening. You will need to obtain your own credit reports, and when you sign up we will provide you with simple instructions and walk you through it. Back to Questions

How much does bad credit cost?

The cost of credit repair is small compared to the cost of living with bad credit.

The difference between buying a $20,000 car with good credit vs. bad credit can be as much as $200/month, or $12,000 over a 5-year loan.

The consequences of having damaged credit when buying a vehicle is nothing compared to the effect of damaged credit on a home loan. A typical home of $150,000 can cost as much $70,000 more in interest over the term of a 30-year loan, if you are buying the home with damaged credit — IF you can even buy a home in today’s market.

Credit Cards

Typically you will not be able to get an unsecured credit card with damaged credit. The secured card accounts you may be approved for will typically have higher rates and low limits.

Insurance premiums are usually higher, and certain job positions may not be available to you.

It all adds up! Back to Questions

How long have you been doing credit repair?

Upgrade My Credit has a staff with almost 6 years of experience in the lending, mortgage, real estate, and credit repair fields which uniquely positions us to offer the most up-to-date and comprehensive services to our clients. Back to Questions

How does the process work?

On a real basic level, the following is credit repair in a nutshell:

Once we’ve received your credit reports, we will analyze your credit history to identify items that are responsible for bringing your credit score down – including not having enough current positive credit. We will recommend and provide ways to increase your score, as well as draft letters to dispute the negative items on your behalf that may not be yours, are not being reported correctly, or are obsolete. Upgrade My Credit’s letters are expertly designed such that credit bureaus will accept the dispute and conduct an investigation.

A disputed credit listing must be verified as accurate for it to remain on the credit report. If the credit listings contain an error, the credit bureau may simply correct the item, but, very often, disputed credit items cannot be verified, and by law cannot be reported if it remains inaccurate. Furthermore, the investigation must be completed within 30 days or the listing must be removed.

At the conclusion of the credit bureau’s investigation, a new copy of the credit report is sent to you along with any deletions or improvements. You then provide us with a copy of the new credit report and the cycle repeats itself at strategic intervals. Back to Questions

How long does it take?

Everyone wants you to see results immediately. Although everyone’s credit history is different, most people will see progress within the first 45 days of their membership. The majority of time is spent waiting for the credit bureaus to respond to requests. We take great effort in getting our disputes to the bureaus as fast as possible. As a reference, the average person with 7-10 inaccurate, misleading or obsolete items on each credit report should be prepared for a 3-6 month commitment. It truly depends on each person’s situation. Back to Questions

What if removed items reappear?

This happens occasionally either by accident or a creditor has eventually verified a particular item. This is what is known as a ‘soft delete’. The FCRA (Fair Credit Reporting Agency) has made it much more difficult for a creditor to replace an item once it has been removed. Upgrade My Credit will re-challenge the item with the full force of the prior removal in our favor. We are here for you for a full 12 months as your credit consultant. Back to Questions

Is Credit Repair legal?

Yes, you are given the right under the Fair Credit Reporting Act (FCRA), including the right to challenge inaccurate, misleading and obsolete items that are unverifiable appearing on your credit report. Upgrade My Credit uses every venue available to you under the law to help you assert these rights. Back to Questions

Is it Legal for Upgrade My Credit to help me?

Disputing items on your credit report is your legal right (see the Fair Credit Reporting Act). When you use Upgrade My Credit to help repair your credit, we are abiding by and using all federal and regional laws regulating third party credit repair assistance according to CROA (Credit Repair Organizations Act). Back to Questions

How much does your service cost?

Since each case if different, our fees vary depending on each client’s starting point and goals. Rest assured, they are always budget-friendly, and spouses or a second person signing up at the same time is eligible for a huge discount. Make sure and talk to a representative to get a more accurate cost quote. Back to Questions

What is a credit score?

A credit score is a numerical ranking system that lenders use to determine how much of a credit risk you are. A credit score is a numeric indication of how likely you are to repay debts such as loans or lines of credit. Lenders use this number to determine how much of a credit risk you are.

Credit scores also are designed to indicate your creditworthiness in comparison with other consumers.

Credit scores are based on the data in your credit report and are generated by computers using artificial intelligence. Usually a credit score is between the numbers 300 to 900. The higher your score, the more “creditworthy” you are to lenders. Back to Questions

What is my credit score based on?

Credit scoring is based on many factors that may include:

- Amount of available credit

- Payment history

- Recent requests for credit

- Amount of credit currently being used

- Length of credit history

Under the Equal Credit Opportunity Act, credit scoring may not use gender, marital status, national origin, race, or religion as factors. Back to Questions

How can bad credit be deleted?

Negative credit listings that are inaccurate, unverifiable or absolete are deleted from peoples’ credit reports each and every day!

Upgrade My Credit is hard at work every day challenging damaging and questionable credit entries on behalf of its clients. Utilizing proven and absolutely legal methods, Upgrade My Credit is a professional organization working for you and your credit. If an item is inaccurate, unverifiable, or reporting outside of legal time constraints it must be deleted. See “How does the process work?” Back to Questions

Do I Need to Pay My Bills?

YES…If an item is deleted that still has a balance, the actual debt remains. You still owe the same amount of money that you owed to begin with. If you don’t pay the debt, the creditor or collection agency could always report the item again. So removing the listing without addressing the debt is only a temporary solution. Back to Questions

What do I need to do to get started?

Coming soon, we will provide an online sign up process. For now, please contact a representative or simply click the button below. You can also click here to download the application and send it back to us. After we receive the paperwork back, a representative will call you within 24 hours, and an email with instructions for the next step will be sent to you. Back to Questions