Credit Scores Used By Consumers and Lenders Can Differ

October 1, 2012 | Posted by Blair Warner | No CommentsCONSUMER FINANCIAL PROTECTION BUREAU STUDY FINDS CREDIT SCORES USED BY CONSUMERS AND LENDERS CAN DIFFER

One out of Five Consumers Likely to Receive Meaningfully Different Score than Creditor

WASHINGTON, D.C. – Sept. 25, 2012, the Consumer Financial Protection Bureau (CFPB) released a study comparing credit scores sold to creditors and those sold to consumers.

WASHINGTON, D.C. – Sept. 25, 2012, the Consumer Financial Protection Bureau (CFPB) released a study comparing credit scores sold to creditors and those sold to consumers.

“This study highlights the complexities consumers face in the credit scoring market,” said CFPB Director Richard Cordray. “When consumers buy a credit score, they should be aware that a lender may be using a very different score in making a credit decision.”

The complete Analysis of Differences between Consumer and Creditor-Purchased Credit Scores is available at: http://files.consumerfinance.gov/f/201209_Analysis_Differences_Consumer_Credit.pdf

The Dodd-Frank Wall Street Reform and Consumer Protection Act directed the CFPB to compare credit scores sold to creditors and those sold to consumers by nationwide credit bureaus and to determine whether differences between those scores harm consumers.

THE STUDY DETERMINED:

-

One out of five consumers would likely receive a meaningfully different score than would a creditor: When consumers purchase their score from a credit bureau. A meaningful difference means that the consumer would be likely to qualify for different credit offers – either better or worse – than they would expect to get based on the score they purchased.

- Score discrepancies may generate consumer harm: When discrepancies exist between the scores consumers purchase and the scores used for decision-making by lenders in the marketplace, consumers may take action that does not benefit them. For example, consumers who have reviewed their own score may expect a certain price from a lender, may waste time and effort applying for loans they are not qualified for, or may accept offers that are worse than they could get.

- Consumers unlikely to know about score discrepancies: There is no way for consumers to know how the score they receive will compare to the score a creditor uses in making a lending decision. As such, consumers cannot exclusively rely on the credit score they receive to understand how lenders will view their creditworthiness.

RECOMMENDATIONS:

- Shop around for credit. Consumers benefit by shopping for credit. Regardless of the scores different lenders use, they may offer different loan terms because they operate different risk models or face different competitive pressures. While some consumers are reluctant to shop for credit out of fear that they will harm their credit score, that actual negative impact is exaggerated. Inquiries generally do not result in a large reduction in a consumer credit score.

VERY IMPORTANT – Check the credit report for accuracy and dispute errors. Credit scores are calculated based on information in a consumer’s credit file. Inaccurate information may be the difference between a consumer being approved or denied a loan. Before shopping for major credit items, the Bureau recommends that consumers review their credit files for inaccuracies

Thanks to contributions from the California Association of Mortgage Professionals

By Blair Warner

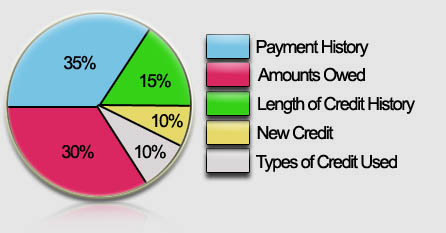

A common question I get asked is, “what is the secret to a good credit score?” I always hate to answer it so matter-of-factly and quickly because I know they are hoping I can perform magic. The simple answer is, though, the only way to get one is to demonstrate financial responsibility. “Creditors don’t care about how many millions you may have in your investment account, it’s how you use your credit,” says Maxine Sweet, vice president, public education for Experian.

A common question I get asked is, “what is the secret to a good credit score?” I always hate to answer it so matter-of-factly and quickly because I know they are hoping I can perform magic. The simple answer is, though, the only way to get one is to demonstrate financial responsibility. “Creditors don’t care about how many millions you may have in your investment account, it’s how you use your credit,” says Maxine Sweet, vice president, public education for Experian.